How can Developers Benefit from Today’s Market Conditions?

If you are starting or completing a Real Estate Development project, you can benefit from today’s market.

1) In general, while closing either an acquisition, construction and Bridge loan, we are targeting rates that float on SOFR. The Market projections for SOFR over the past 6 months have been right on track. The Forward Expectations chart below is actually from 6 months ago, but has little changed since. Overall, the Market is still anticipating that SOFR will fall by another 50~ bps hitting a trough of 3.17% between January & May of 2027.

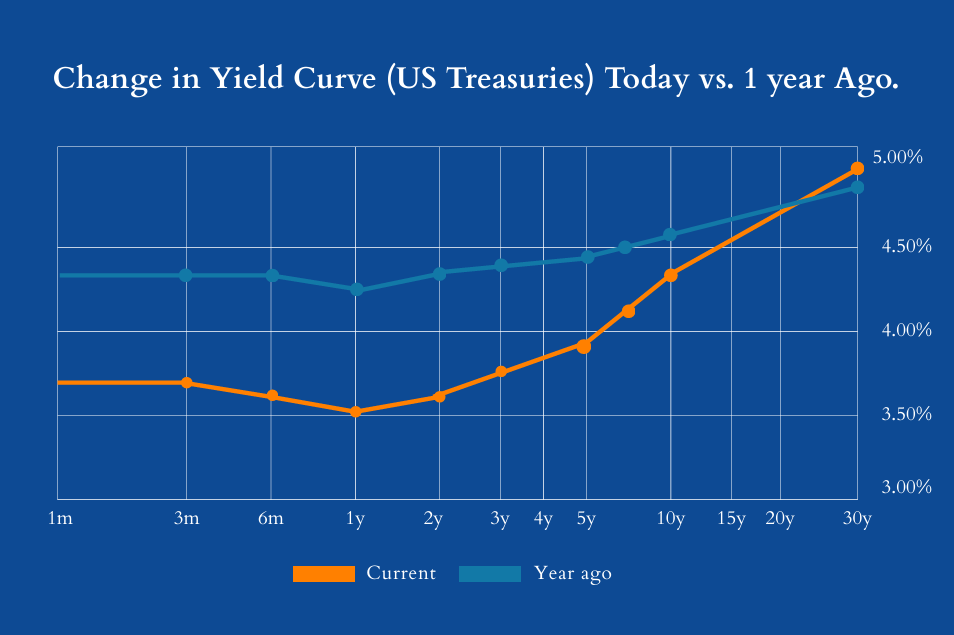

*Note: If your favorite Lender can only use a US Treasury as the underlying benchmark, we are targeting the 3 Year UST, which is the low point of the Yield Curve, at 3.66%.

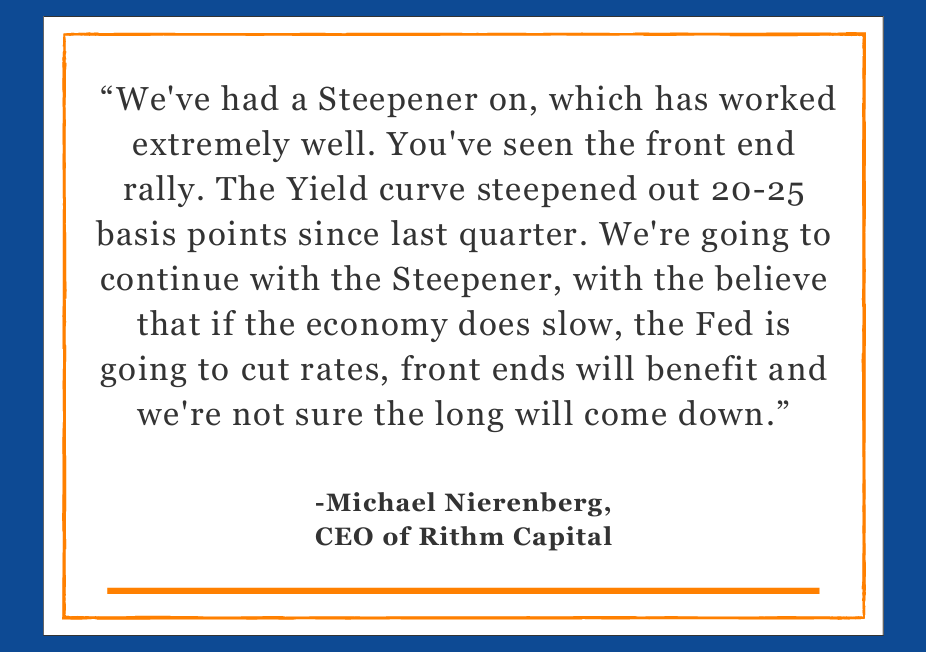

2) As short term rates have declined, the long-end of the Yield Curve has stayed elevated. This movement reflects a “Steepening” Yield Curve (see the comparison Chart below). For anyone, who follows Public Companies and RE Finance, you will love listening to Michael Nierenberg the CEO of Rithm Capital on his Quarterly earnings calls. Some of you may know or borrow from Rithm, who is the parent company of Genesis Lending and Caliber Mortgage. Here are a few words of his wisdom from back in July of 2025…

3) We continue to follow Michael’s sage advice as we help Clients size and review exit options. We don’t anticipate any reprieve to the long end of the yield curve, and can point to several underlying pressures that may keep it elevated. However, we do recommend going to the negotiation table for an acquisition, construction, or bridge loan with your take-out loan planned. For example, if you are closing on an Acq/Rehab loan show that lender who will be taking them out in 24-36 months. It helps to be conservative in your estimate, and is a useful tool in negotiating the terms of your loan.

The Most Valuable Resource of all time is the American Entrepreneur.

Many of the incredible Developers in our community are true Entrepreneurs, Heroes of today. In this spirit, we’ve loved sharing a few of our favorite reads including:

First Entrepreneur about George Washington’s business acumen;

The Wright Brothers by David McDonagh;

ShoeDog Phil Knight’s memoir about Nike’s formative years.

This month, we’re showcasing Culture Code: The Secrets of Highly Successful Groups by Daniel Coyle. If you work with others and want to take your Projects to a new level in 2026, this is Book is an excellent read!

Congrats to those Developers who have recently secured site control on a new development project, Including two of our Clients recently got into contract to purchase land for development projects at attractive price points.

If you are in contract & looking for an acquisition loan (for land or an acq/rehab project), we’d love to learn more about the opportunity or share how we’ve been approaching smarter capital structures for our Clients. Photo: Successfully organizing the best pathway for a fully funded Acq/Rehab project in San Diego.

Alternatively, if you are looking for new Development projects, don’t hesitate to call us to review your ideal development criteria. Our Office keeps tabs on more than 1,700 active approvals in California, so we likely have a number of on-and-off market deals to share with you for purchase or JV.